Permissions

This area requires a Finance licence for access.

Users can view the information, while Super Users, Owners, and Internal Users can maintain and update the data.

Active Charges

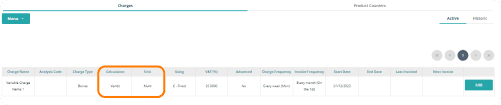

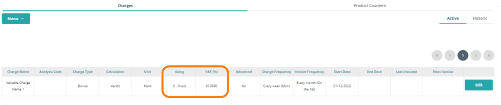

Within the Finance tab, there is a section called Charges that displays the charges assigned to the machine you're viewing. For each charge, you can see the Charge Name, the associated Analysis Code, and the Charge Type.

The Calculation column shows what the charge is based on. For Fixed Charges, this will display "None" as it is a flat amount.

The Unit column shows the charge price. If there are multiple values for a Penalty or Bonus, the Unit column will display "Multi."

Benefit: Clear identification of charge calculations and units helps with accurate financial interpretation and ensures transparency in billing.

The Using column shows whether the calculation is based on a fixed monetary amount or a variable amount in pence.

The VAT (%) column displays the VAT rate applied to the charge.

If a charge is billed in advance, the Advanced column will display "Yes."

The Charge Frequency shows how often the charge is generated, while the Invoice Frequency indicates how often the charge will appear on the invoice.

The Start Date shows when the charge begins, and the End Date displays when it will stop being charged.

The Last Invoice column shows the date of the most recent charge, while Next Invoice indicates when the charge will next appear on an invoice.

To amend a charge assigned to a machine, select Edit next to the charge you wish to modify.

Add New Charge

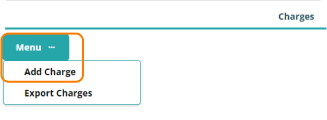

To add a new charge to the machine, select Menu, then choose Add Charge.

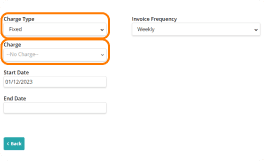

After selecting Add Charge, you will be directed to a form where you need to choose the Charge Type —Fixed, Penalty, or Bonus. Once you’ve selected the Charge Type, the Charge dropdown will display options corresponding to the selected type for you to apply.

You can set the Start Date of the charge to any date in the past or future, but it cannot be set beyond the End Date. The End Date can be left empty if the charge is indefinite, but you may also specify an end date if you know when the charge will cease.

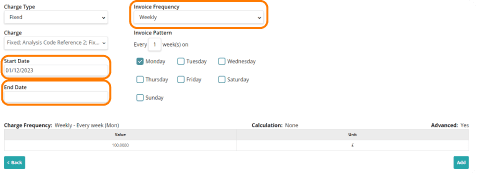

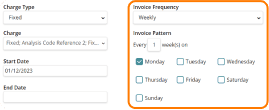

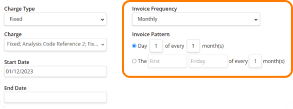

The Invoice Frequency is initially set to match the Charge Frequency of the charge you’ve chosen. You can amend the Invoice Frequency, with the following options available:

One-Off: This option cannot be changed if the selected charge has a One-Off charge frequency.

Weekly: Allows you to select a specific day for the invoice pattern and determine how often the charge is invoiced.

Monthly: You can choose either a specific date for the invoice to occur each month or a specific day of the week. You can also set the frequency of how often this invoicing should happen.

Period: This option uses the Financial Periods created in Administration → Sales → Financial Periods, with no specific invoice pattern.

Quick Tip

Charges will not appear in the Charge dropdown if:

They are marked as inactive.

They are not associated with the selected Charge Type.

The Charge is already active for the machine.

Benefit: This ensures that only relevant and applicable charges are available for selection, preventing errors and maintaining accurate charge management.

Add New Charge

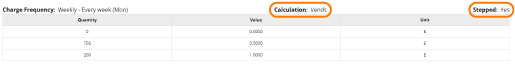

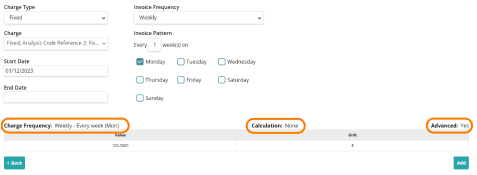

At the bottom of the Add Charge page, you can view the Charge Frequency of the selected charge.

For Fixed Charges:

The Calculation will be set to "None," indicating a flat amount.

The Advanced setting will display "Yes" if the charge is to be paid in advance.

For Penalties and Bonuses:

The Calculation will be set according to the option selected when creating the charge.

You can also determine if the charge is Stepped.

Each charge will display the unit price to be charged.

For Fixed Charges, there will be a single line in this table.

For Variable Charges, multiple lines may appear depending on the quantity or value breaks created.

After entering the desired details, select Add to apply the charge to the machine.

Quick Tip

When using calendar periods, ensure that the Start Date you enter aligns with the end date of the last invoice period. This ensures the charge is calculated accurately for the entire period.

Benefit: Accurate date alignment prevents gaps in invoicing and ensures charges are correctly applied for each financial period.

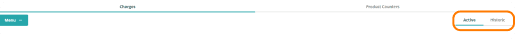

Active and Historic Charges

When you first access the Finance tab, the Charges section will open with Active charges displayed.

To view historic charges for the machine, select the Historic option on the right-hand side of the page.

Any charges classified as historic—where the end date is before the current day—will be displayed here.

The same columns are used for both Active and Historic charges, but historic charges cannot be edited.

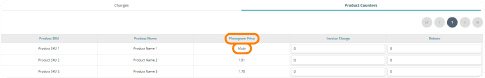

Product Counters

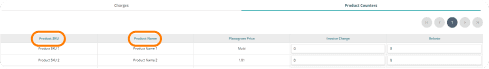

Within the Finance tab, there is a section for Product Counters.

This provides a list of all products set up on the planogram, allowing you to view the Product SKU and Product Name for each item.

The Planogram Price displayed reflects the price set against the planogram. If the same product has multiple prices, the column will display "Multi."

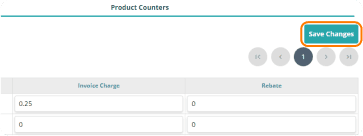

You can set the Invoice Charge for each product by selecting the row and entering the desired charge per product.

Similarly, you can set the Rebate for each product by selecting the row and entering the value you wish to return per product.

Once you have entered the necessary values for the Invoice Charge and Rebates, select Save Changes to apply the updates to the machine.

Benefit: This ensures that all changes are securely saved and immediately reflected, streamlining the process of managing product-specific charges and rebates.